Source: Mining Dot Com

By: Nelson Bennett

Date: December 9, 2022

Canada is blessed with an abundance of fossil fuels — oil, natural gas and coal.

But as the developed world tries to wean itself off of fossil fuels – largely through electrification – it is expected the demand for Canada’s fossil fuels will eventually decline, while demand for critical minerals and metals is projected to grow sixfold by 2040.

These metals and minerals are critical in manufacturing electric vehicle batteries, solar and wind power installations, transmission lines and all the other things that a global energy transition will require.

The Canadian government is hoping to capitalize on the opportunity this poses with a new critical minerals strategy — backed with $4 billion in funding in the recent federal budget — that aims to develop a full critical minerals industry value chain, from exploration and mining, to processing, manufacturing and recycling.

Federal Natural Resources Minister Jonathan Wilkinson is in Vancouver today to release the new strategy.

“By investing in critical minerals today, we are building a sustainable industrial base to support emission-reducing supply chains that will address climate change for generations to come,” the Canadian Critical Minerals Strategy states.

Citing Clean Energy Canada, the strategy estimates $5.7 billion to $24 billion in GDP could be created by 2030 annually by developing a battery supply chain, creating 18,500 to 81,000 direct jobs.

“These figures grow to between $15 billion and $59 billion in annual GDP contributions, and 79,000 and 333,000 jobs, when indirect and induced activities and jobs are included,” the strategy says. “Once realized, these activities would contribute between $2.7 billion and $11 billion annually in combined federal and provincial government revenues.”

Not everyone is convinced Canada has what it takes to become a critical minerals powerhouse, however. Namely, it just doesn’t have the mineral reserves that regions like South America and Africa have, say Philip Bazel and Jack Mintz of the University of Calgary’s School of Public Policy.

In a brief published earlier this week, they suggest Canada will remain a minor player in critical minerals production, simply because it doesn’t have the massive reserves of copper, lithium, cobalt and other critical minerals that countries like Chile and the Democratic Republic of Congo have.

Based on reserves and production of eight critical minerals and metals, among the top six producers, Canada ranks last, according the Bazel-Mintz brief.

They estimate Canada’s global share of copper reserves to be just 1.1% — compared to Chile’s 22.7% — and production at 2.8%. It’s estimated share of nickel and zinc reserves are roughly 2%. Canada’s share of global nickel production was 6.7% in 2020; its share of zinc production was 6%. Canada’s reserves share of cobalt is 2.9% and its production share 2.6%. Its global share of lithium, bauxite and manganese production is currently zero, according to the Bazel-Mitz brief.

“Most of North America’s critical transition minerals will have to come from reserves in South America, Africa, and the Caribbean as well as Australia and China, which will see economic growth from mining jobs and capital investments,” they write.

“Shifting away from carbon-emitting fossil fuels toward cleaner, renewable sources of electric energy will require no less than an order of magnitude more mined minerals and rare earth elements, and Canada has a limited share of these transition minerals.”

But reserve estimates are based on what is known, and there may be more deposits in Canada yet to be discovered. The strategy earmarks $79 million for public geoscience and exploration aimed at discovering potential new deposits. Moreover, Canada’s new critical minerals strategy doesn’t just focus on raw resources. It proposes an end-to-end industry value chain, from exploration and mining, to processing, manufacturing and recycling.

Ottawa is also hoping a Canadian critical minerals industry will be able to piggyback on American policies, like the Inflation Reduction Act, which will pump billions into things like electric vehicles, potentially opening up opportunities for Canada and the U.S. to cooperate on the development North American supply chains.

“Where critical minerals are not used solely for domestic manufacturing, there is value to be captured by increasing exports for allies, and expanding domestic refining, processing and components manufacturing,” the strategy states. “Examples of these minerals are vanadium, gallium, titanium, scandium, magnesium, tellurium, zinc, niobium, and germanium, along with potash, uranium and aluminum.”

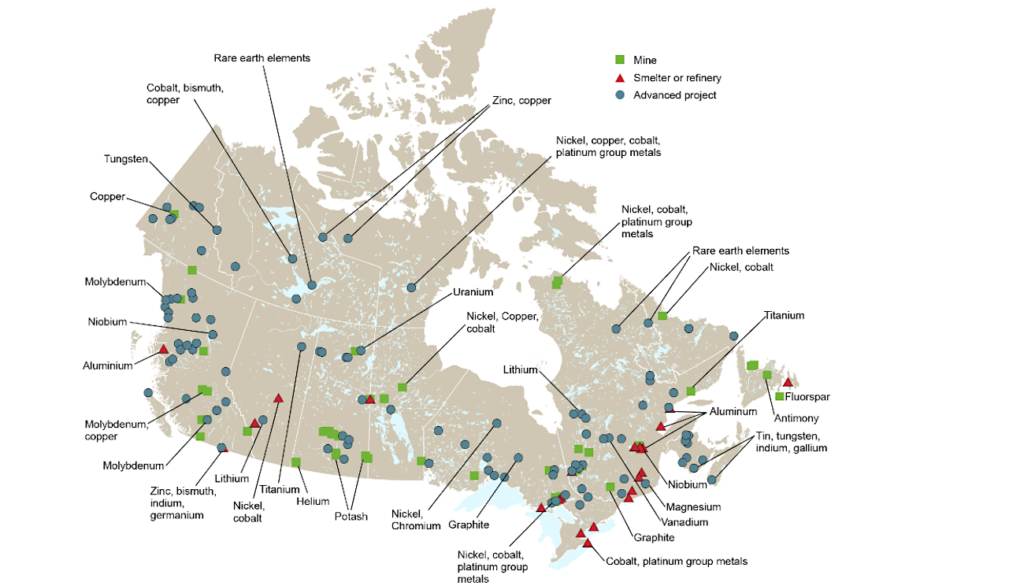

Of the 31 critical minerals identified in the strategy, six are “prioritized” – lithium, graphite, nickel, cobalt, copper, and rare earth elements.

Canada already produces some nickel, cobalt and copper – B.C. being the biggest copper producer. And Saskatchewan is a major producer of uranium, which is among the 31 minerals identified in the new strategy.

There are, as yet, no operating lithium mines in Canada, although a proposed new lithium mine in Quebec is now making its way through the Impact Assessment Agency process.

The exploration and mining sector in Canada may need some prodding to convince it to switch its focus from gold and coal, however. A casual reading of the list of mining projects currently in the Impact Assessment Agency queue underscores that mining in Canada is still focused mainly on gold and metallurgical coal mining.

Of the 26 development projects listed, only five are for minerals and metals other than gold or coal. They include a nickel mine in Ontario, a lithium mine in Quebec, an iron mine in Labrador, a niobium mine in B.C. and also a lead-zinc mine in B.C.

“Although Canada does not possess large quantities of critical minerals relative to global totals, Canadian reserves of cobalt, copper, nickel and zinc represent the best opportunities for growth,” Bazel and Mintz say in their brief. “However, with the majority of these critical mineral reserves abroad, we wonder if Canada’s industry is positioned to compete for the international mining investment.

“Given Canada’s limited share of global energy transition minerals, securing Canadian participation in the energy transition mining market may indeed hinge on the shape of its regulatory and taxation framework for mining companies.”

The strategy does provide some tax incentives, notably a new 30% flow-through tax credit for critical minerals exploration.