Source: Mining Dot Com

By: Ranjeetha Pakiam, Swansy Afonso, and Mark Burton

Date: Sept 05, 2022

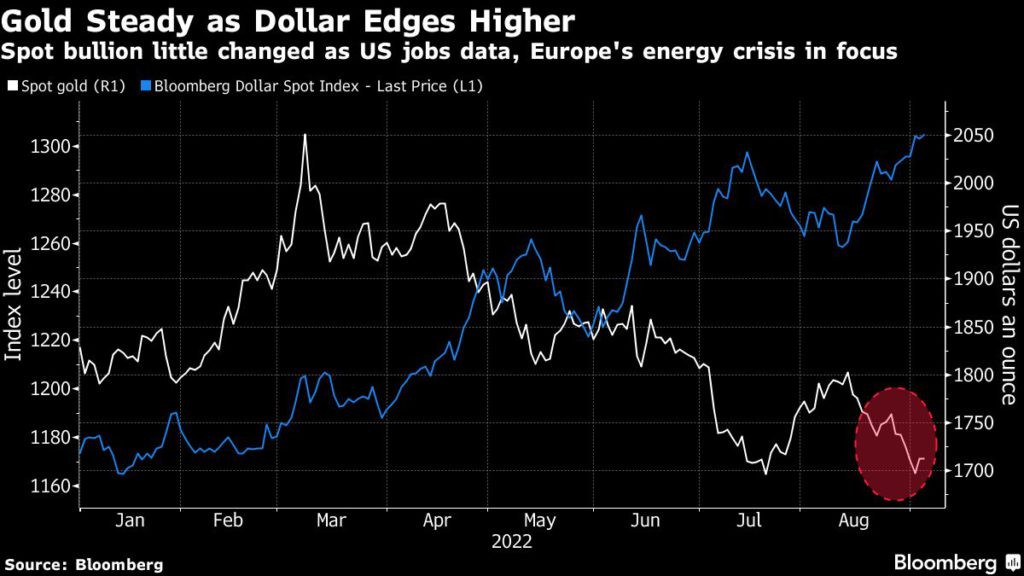

Gold was steady as mounting concerns over a worsening energy crisis in Europe drove investors to the greenback over the euro.

Europe’s currency slumped a 20-year low against the dollar as regional energy prices surged after Russia’s Gazprom PJSC halted its key gas pipeline indefinitely. Germany — the nation most affected by the Nord Stream pipeline cutoff — unveiled a $65 billion package to protect consumers. On Friday, European ministers will discuss special measures to rein in soaring energy costs, from gas-price caps to a suspension of power derivatives trading. The euro fell 0.3% on Monday.

Bullion climbed Friday to pare a third straight weekly drop after a US jobs report showed employers added a healthy number of jobs in August and a steady stream of people entering the workforce lifted the unemployment rate. This suggested some easing in the tight labor market and offered mixed implications for the Federal Reserve’s monetary policy tightening path.

Central banks globally are set to keep raising interest rates to fight inflation, weighing on non-yielding assets like gold. There are growing expectations for the European Central Bank to hike by 75 basis points as soon as Thursday, but the decision remains a challenging one as chief Christine Lagarde and her colleagues manage the twin problems of high price pressures and an impending recession.

“The general outlook for gold remains weak with market players positioning for the ECB meeting this week,” said Ravindra Rao, head of commodity research at Kotak Securities Ltd. While a firm dollar and weak investor interest weigh on gold, Europe’s power crisis, China’s virus outbreak and renewed US-China tensions could lend some support to the precious metal, he said.

Spot gold edged lower to $1,710.60 an ounce as of 4:30 p.m. in London, after rising 0.9% on Friday. The Bloomberg Dollar Spot Index advanced 0.2%. Platinum gained, while silver and palladium were little changed.

(By Ranjeetha Pakiam, with assistance from Swansy Afonso and Mark Burton)