Source: Seeking Alpha

By: Peter Arendas

Date: Sept 09, 2022

Summary

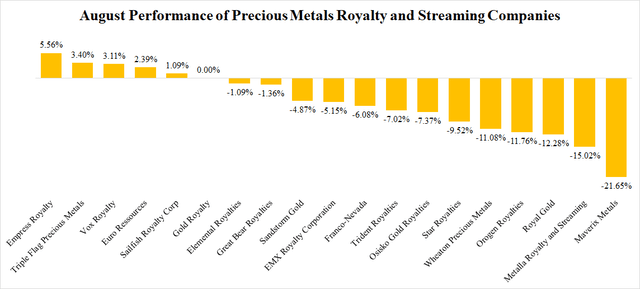

- The Precious Metals R&S Index decreased by 7.65% in August.

- The Precious Metals R&S Equally Weighted Index decreased by 5.2%.

- The best performance was recorded by Empress Royalty; its share price grew by 5.56%.

- The biggest decline was experienced by Maverix Metals; its share price declined by 21.65%.

- I do much more than just articles at Royalty & Streaming Corner: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

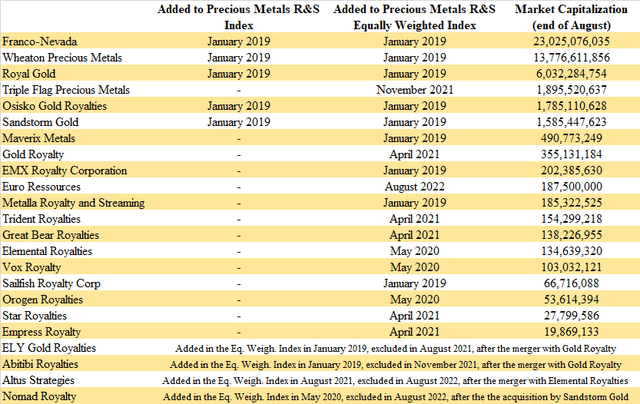

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021 (extended), October 2021 (extended), November 2021 (extended), December 2021 (extended), January 2022 (extended), February 2022 (extended), March 2022 (extended), April 2022 (extended), May 2022 (extended), June 2022, June 2022 (extended), July 2022 (extended), July 2022, August 2022 (extended).

Source: Own Processing

In August, Sandstorm Gold completed the acquisition of Nomad Royalty, and the merger of Elemental Royalties (OTCQX:ELEMF) and Altus Strategies was completed as well. As a replacement, Euro Ressources (OTC:ERRSF) was introduced to the list of the precious metals R&S companies and to the Precious Metals R&S Equally Weighted Index. The company is 90%-owned by IAMGOLD (IAG) and its main assets are royalties on the Rosebel mine and Paul Isnard project, and silver stream on the Bombore mine. As shown in the table above, with a market capitalization of nearly $200 million, Euro belongs to the mid-sized precious metals R&S companies.

Source: Own Processing

In August, the majority of companies, 13 out of 19, recorded a share price decline. The biggest one, by more than 20%, was experienced by Maverix Metals (MMX). The poor performance is attributable to the uncertainty regarding the Russian Omolon mine and the resulting downwards revision of the 2022 guidance. On the other hand, the best performance, a nearly 6% growth, was experienced by the smallest of the followed companies, Empress Royalty (OTCQB:EMPYF). Empress benefited from the positive momentum that dates back to early July when two of its assets got into production.

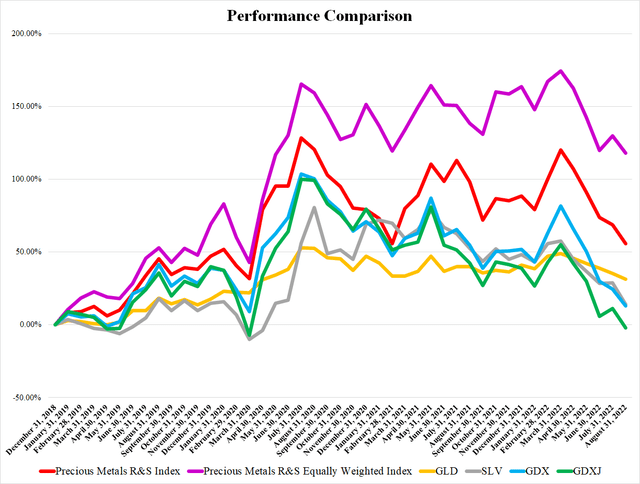

Source: Own Processing

Gold and especially silver didn’t do well in August. The share price of the SPDR Gold Trust ETF (GLD) declined by 2.94%, and the share price of the iShares Silver Trust ETF (SLV) declined even by 11.34%. This, along with the broader stock market weakness, weighed on the precious metals miners. The VanEck Vectors Gold Miners ETF (GDX) declined by 9.4%, and the VanEck Vectors Junior Gold Miners ETF (GDXJ) even by 11.93%. Although the precious metals R&S companies did slightly better, they were unable to avoid meaningful losses. The Precious Metals R&S Index lost 7.65%, and the Precious Metals R&S Equally Weighted Index lost 5.2% of its value. What is interesting, the Green R&S Equally Weighted Index grew by 0.4%

The August News

In August, the majority of news was related to Q2 earnings reports. However, there were also several deals. The biggest one made Royal Gold that acquired an effective 1.2% gross royalty on the Cortez Complex. However, as the numbers show, the price paid for this royalty is pretty high.

Franco-Nevada (FNV) reported record-high sales. The company sold 191,052 toz of gold equivalent in Q2, generating revenues of $352.3 million. Compared to the previous quarter, the gold equivalent sales increased by 7%, and the revenues increased by 4%. Gold accounted for 54% of the revenues, followed by oil (13%), natural gas (11%), silver (10%), and other commodities (12%). The operating cash flow amounted to $257.3 million which is 11.6% more than in Q1. The net income grew by 8%, to $196.5 million. Franco ended the quarter with cash of $910.6 million and no debt. Franco also declared a quarterly dividend of $0.32 payable on September 29, to shareholders of record as of September 15.

Wheaton Precious Metals sold 170,371 toz of gold equivalent (84,337 toz gold, 5.848 million toz silver, 3,378 toz palladium, 225,000 lb cobalt), generating revenues of $302.9 million. The gold equivalent sales increased by 2.6%, but the revenues declined by 1.4% compared to Q1. The operating cash flow declined by 2% to $206.4 million, and net income declined by 5.3% to $149.1 million. Wheaton ended the quarter with cash of $448.6 million. Due to the termination of the Keno Hill stream, and worse-than-expected Stillwater and Salobo mine operational performance, Wheaton revised its 2022 guidance. The original expectation was attributable production of 700,000-760,000 toz of gold equivalent, the new one is 640,000-680,000 toz of gold equivalent. Wheaton Precious Metals also declared a Q3 dividend of $0.15 per share, payable on September 8 to shareholders of record as of August 26.

The company also announced that it agreed to terminate its Yauliyacu silver stream. As compensation, Glencore (OTCPK:GLCNF) will pay Wheaton $150 million less the aggregate value of any deliveries to Wheaton of silver produced in 2022 prior to closing. The deal is conditioned by Glencore divesting the Yauliyacu mine by December 31, 2022. The termination of the stream will reduce Wheaton’s annual attributable production volumes by approximately 20,000 toz of gold equivalent.

Royal Gold reported its Q2 financial results. The company sold 78,300 toz of gold equivalent (71% gold, 14% copper, 11% silver, 4% other), generating revenues of $146.4 million, which is 8.6% less than in Q1. The reason is lower gold equivalent sales and lower realized prices. However, the operating cash flow increased from $101.1 million to $120.2 million. The net income increased by 8.2% to $71.1 million. Royal Gold ended the quarter with cash on hand amounting to $280.6 million and no debt.

On August 2, Royal Gold announced a $525 million acquisition of an effective 1.2% gross royalty on Barrick Gold’s (GOLD) and Newmont’s (NEM) Cortez Complex. The royalty payments should start in Q3 or Q4, depending on when the cumulative production (beginning on January 1, 2008), exceeds 15 million toz of gold equivalent. It is expected that the Cortez Complex production will grow to 1.3 million toz gold per year by 2027. The reserves contain 14 million toz gold, and resources (including reserves) contain 24.8 million toz gold. A detailed analysis of this deal that doesn’t look good for Royal Gold can be found here.

The company also declared another quarterly dividend of $0.35 per share. It will be paid on October 21, to shareholders of record as of October 7. After annualizing, the current dividend yield equals 1.4%.

Sandstorm Gold reported that its attributable gold equivalent production reached a record high of 19,276 toz in Q2. It is 2.9% more than in Q2. Also the revenues reached a record high, at $36 million. However, when compared to Q2, the operating cash flow declined by 18% to $21.9 million. The net income amounted to $39.7 million which is a new record high. However, the Q2 net income was inflated by a $22.9 million gain on the disposal of a portfolio of royalties to Sandbox, and a $12.5 million gain from the sale of the equity interest in Entree Resources (EGI) to Horizon Copper. Sandstorm ended Q2 with cash of $18.5 million. The company expects the 2022 attributable production to total 80,000-85,000 toz of gold equivalent. It should increase to 155,000 toz of gold equivalent by 2025 (including the impact of the Nomad Royalty acquisition).

In early August, Sandstorm Gold’s shareholders approved the Nomad Royalty acquisition. As much as 99.07% of casted votes were for. Subsequently, on August 15, the completion of the acquisition was announced.

And on August 31, Sandstorm Gold completed the transaction with Horizon Copper announced back in May. The ownership of Sandstorm’s interest in the Hod Maden project was transferred to Horizon. Horizon received also $10 million and 25% equity stake in Entree Resources. Sandstorm received a $200 million gold stream on Hod Maden, 34% equity interest in Horizon Copper, and $95 million convertible promissory note.

Triple Flag Precious Metals (TFPM) sold 19,507 toz of gold equivalent in Q2, which is 3% less than in Q1. The revenues declined as well, from $37.8 million to $36.5 million. What is positive, the operating cash flow increased by 13%, to $29.9 million. But the net income declined by nearly 1/3, from $15.9 million in Q1 to $10.9 million in Q2. The company ended Q2 with cash of $74.4 million and no debt. Triple Flag also announced that its shares will start trading on NYSE soon. Moreover, the company increased the quarterly dividend from $0.0475 to $0.05. The next one will be paid on September 15, to shareholders of record as of August 31.

On August 25, Triple Flag Precious Metals announced that it will participate on a $93 million financing package for Nevada Copper (OTCPK:NEVDF). Triple Flag will purchase an additional 1.3% NSR royalty on the Pumpkin Hollow open pit copper mine for $26.2 million. It will bring Triple Flag’s total royalty to 2%. However, Nevada Copper will have 2 years to repurchase the new 1.3% royalty for $33 million. Triple Flag will also accelerate the payment of the remaining unfunded deposit in the amount of $3.8 million under the existing metals purchase and sale agreement between Triple Flag and Nevada Copper. A detailed analysis of this deal that looks very good for Triple Flag can be found here.

Osisko Gold Royalties earned 22,243 toz of gold equivalent in Q2, which is nearly 22% more than in Q1. The consolidated revenues amounted to C$64 million ($49.7 million), including C$12.4 million ($9.6 million) generated by Osisko Development (ODV). Compared to Q1, the revenues increased by 7.7%. The operating cash flow amounted to -C$0.2 million (-$0.16 million), including -$35.2 million (-$27.3 million) attributable to Osisko Development. This represents a significant decline when compared to C$23.6 million ($18.3 million) recorded in Q1. However, the consolidated net income increased from C$0.3 million ($0.23 million) to C$17.2 million ($13.3 million). Osisko ended Q2 with cash of C$449.3 million ($348.5 million), including C$136.3 million ($105.7 million) held by Osisko Development. What is important, in Q2, Osisko Development completed an equity financing related to the Tintic Consolidated Metals’ acquisition, which reduced Osisko Gold Royalties’ equity interest from 70.1% to 44.1%. Osisko Gold Royalties also declared a dividend of C$0.055 ($0.043), payable on October 14, to shareholders of record as of September 30.

Maverix Metals released the Q2 financial results too. It sold 7,649 toz of gold equivalent and recorded revenues of $14.2 million, which is in line with Q1 revenues of $14.7 million. Also the operating cash flow of $8 million is in line with Q1. However, the net income declined by 20% to $2.8 million. Maverix held cash of $18.5 million, and debt of $12.5 million as of the end of Q2. Unfortunately, due to the uncertainty regarding the deliveries of gold from the Omolon mine owned by Polymetal, Maverix revised its 2022 guidance from 32,000-35,000 toz of gold equivalent to 28,000-31,000 toz of gold equivalent.

Gold Royalty (GROY) reported the Q2 financial results as well. Its attributable production amounted to 1,031 toz of gold equivalent, resulting in revenues of $1.9 million, The operating cash flow equaled -$603,000, and the net income equaled -$3.438 million. The company expects 2022 revenues of around $5 million. Moreover, it stated that its portfolio of 198 royalties provides exposure to over 700,000 meters of drilling this year alone. Gold Royalty also initiated a $50 million ATM program.

On August 24, Gold Royalty declared a quarterly dividend of $0.01. It will be paid on September 30, to shareholders of record as of September 20. After annualizing, the current dividend yield equals 1.33%.

EMX Royalty (EMX) recorded revenues of $7 million in Q2. It means a rapid improvement when compared to revenues of $1.8 million recorded in Q1. However, the operating cash flow declined from $15.8 million to -$3.3 million, and net income declined from $18.8 million to -$3.2 million, as the Q1 numbers were inflated by the victory in the Barrick Gold litigation. EMX held cash of $7.6 million, and marketable securities and loans receivable worth $21.3 million as of the end of Q2. Its total debt declined to $39.6 million. Unfortunately, no new information regarding the Timok royalty dispute was provided.

On August 26, EMX Royalty optioned the Mesa Well copper project to Intrepid Metals (INTR:CA). Intrepid will be able to acquire the property by paying EMX $350,000 and 600,000 shares and expending $2 million on the exploration of the property. over the next 5 years. EMX will retain a 2% NSR royalty.

Trident Royalties (OTCPK:TDTRF) recorded revenues of $5.7 million in Q2. It is 155% more than in Q1, however, the Q2 revenues include a $3.7 million one-time item generated by the Premier Gold (OTCPK:PIRGF) offtake agreement restructuring. Without this item, the revenues would be only $2 million, which is approximately 10% less than in Q1. The decline is attributable to lower gold prices and the exclusion of the Mercedes mine from the offtake portfolio. As of July 29, Trident held cash of $21.5 million. The net debt equaled $18.5 million.

The company also announced that at the Rebecca Gold Project, the gold resources increased by 9%, to 1.2 million toz. The update of the resource estimate was based only on slightly more than 9,000 meters of drilling, and more than 65,000 meters should be drilled next year, which offers room for even much bigger growth in the future. Trident owns 1.5% NSR royalty on the Australian project owned by Ramelius Resources (OTCPK:RMLRF).

Sailfish Royalty (OTCQX:SROYF) announced that Mako Mining discovered a new gold-bearing structure on the Las Conchitas-North property to the south of its producing San Albino mine, by drilling 37.28 g/t gold and 34.9 g/t silver over 2.6 meters. Sailfish owns a 2% NSR royalty on Las Conchitas.

Elemental Royalties announced that it received 1,138 toz of gold equivalent and recorded revenues of $2.1 million in Q2. However, the net income was -$2.4 million. Elemental ended the quarter with cash of $5.7 million.

On August 8, Elemental Royalties and Altus Strategies announced that their shareholders voted in favor of the proposed merger of equals. On August 16, the merger was completed.

Before the completion of the merger with Elemental, Altus Strategies released a new resource estimate and PEA for its 100%-owned Diba & Lakanfla gold project. The deposit contains indicated resources of 312,000 toz gold, and inferred resources of 362,000 toz gold. According to the PEA, the mine should be able to produce 54,380 toz gold per year on average, over 7-year mine life. The AISC is projected only at $686/toz, and the initial CAPEX at $28 million. At a gold price of $1,700/toz, the after-tax NPV(8%) equals $150 million.

Metalla Royalty (MTA) recorded attributable production of 560 toz of gold equivalent in Q2. The revenues amounted to $0.5 million (compared to $0.7 million in Q1), and net income to -$1.4 million (compared to -$2.2 million in Q1). Metalla also initiated a $50 million ATM program. The company held cash of $3.4 million and total debt of $10.8 million as of the end of Q2.

Great Bear Royalties (OTCPK:GBRBF) filed a Management Information Circular related to the special meeting of shareholders organized to approve the acquisition by Royal Gold. Great Bear Royalties also reported that Independent Proxy Advisory Firms ISS and Glass Lewis recommend the shareholders to accept the takeover offer.

Vox Royalty (OTCQX:VOXCF) recorded a record-breaking quarter. Its revenues increased to $1.75 million, and its net income to $433,000. Vox held cash of $4.75 million as of the end of the quarter. The 2022 revenue guidance of $7.8-9.4 million remains unchanged.

The company also announced that the Western Australian Environmental Protection Authority approved the expansion of the Wonmunna mine from 10 Mtpa to 13.5 Mtpa. Vox owns a 1.25-1.5% Gross Revenue Royalty over Wonmunna.

On August 18, Vox Royalty provided an update regarding its royalty portfolio. The most important news is the commencement of gold production at the Janet Ivy gold mine. Vox expects its A$0.5/t production royalty to generate A$2-2.5 million ($1.38-1.73 million) per year. Moreover, the Otto Bore mine (Vox holds a 2.5% NSR royalty) should achieve the first production before the end of this year.

Orogen Royalties (OTCQX:OGNRF) released its Q2 financial results. It generated revenues of C$942,325 ($727,000). Almost all the revenues were generated by the 2% Ermitano royalty. The operating cash flow amounted to C$131,280 ($101,000) and the net income to -C$648,635 (-$500,000). The company held cash of C$3.05 million ($2.35 million) as of the end of Q2. What is positive, the Ermitano mine production should increase in H2.

On August 15, Orogen Royalties announced that it staked an epithermal gold-silver target in Durango, Mexico. The project is named La Verdad.

Star Royalties (OTCQX:STRFF) reported its Q3 financial results. The revenues amounted to $264,203 and operating cash flow to -$286,703. However, due to the deconsolidation of Green Star Royalties, Star Royalties recorded a net income of $17.8 million.

The September Outlook

As the Q2 earnings season is over, the news flow will most probably slow down in September. The main force driving the share prices of the precious metals R&S companies will be the development of the global economy and stock markets which doesn’t look too optimistic right now. However, it is important to remember that in the early phases of a crisis and a market sell-off, also precious metals and related assets tend to suffer, as the investors turn into panic mode and are looking for liquidity at all costs. However, they also tend to rebound much quicker and much stronger than the other asset classes. This was well documented also by the global financial crisis of 2008, and the pandemic sell-off of 2020.