By: Alina Islam, Mining Analyst

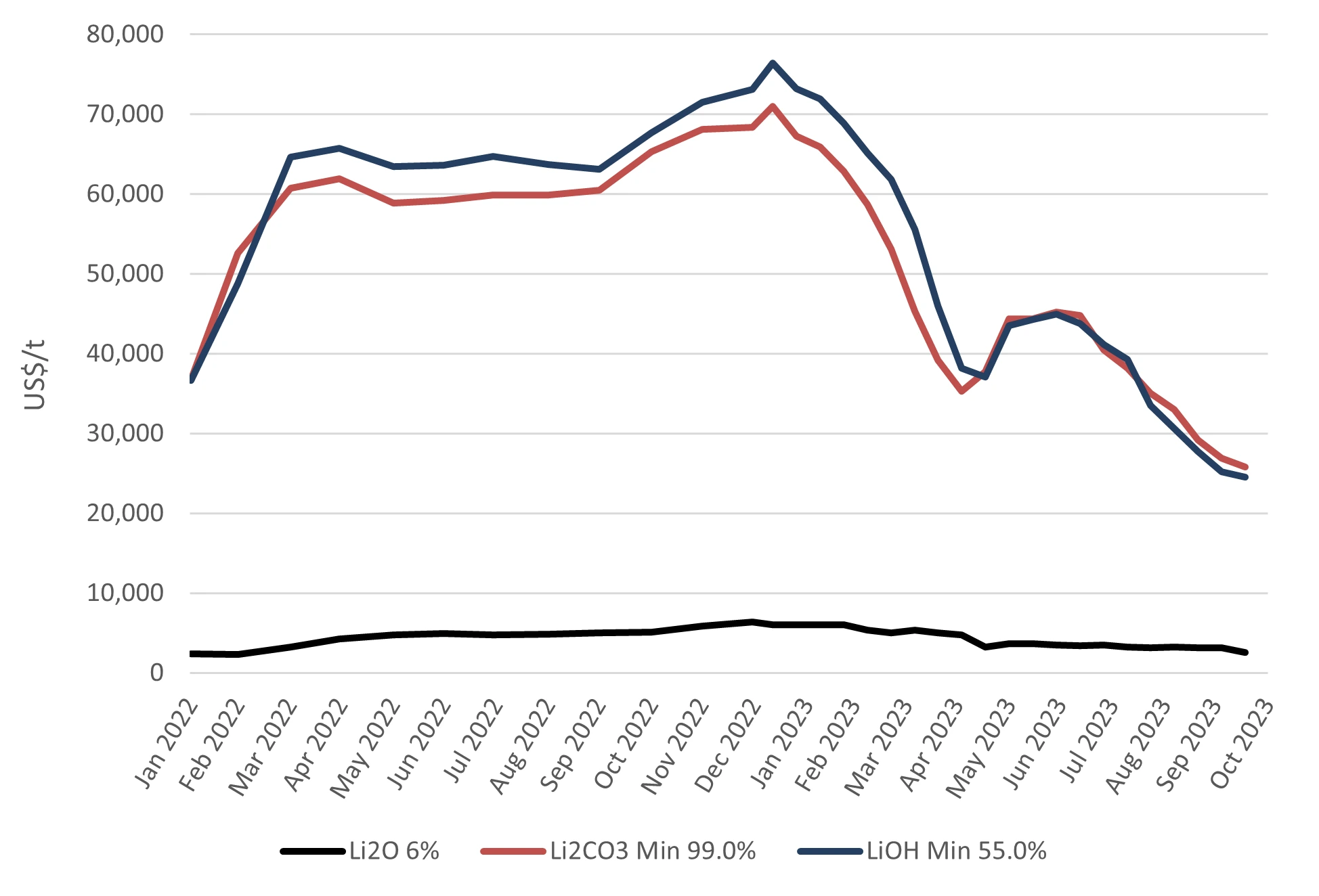

Prices of lithium chemicals (hydroxide and carbonate) and feedstock material (spodumene) saw new highs at the end of 2022/early 2023 (Figure 1). In our opinion, this increase in pricing was driven by several factors including: a projected shortfall in lithium chemical supply in 2022, the anticipated growth in long-term demand from both, the battery storage and electric vehicle (EV) industries, and policies implemented by various governments across the globe to secure energy transition materials in the aftermath of the Russia-Ukraine war. Spodumene price (Li2O 6%) hit US$6,400/t in December 2022, while carbonate (Li2CO3 Min 99.0%) and hydroxide (LiOH Min 55.0%) prices hit its highs in January 2023, touching US$70,957/t and US$76,389/t, respectively, as reported by Benchmark Mineral Intelligence.

Since the highs earlier this year, we have seen a sustained fall in both chemical and feedstock prices, and as of October 18, hydroxide was down by almost 68%, carbonate by 64% and spodumene by approximately 59% from its highest point. Lithium prices have certainly seen a fall from grace; however we believe that a lot of the current pricing sentiment is being driven by a short-term outlook and sentiments from China.

With China dominating the midstream and downstream sectors of the EV battery supply chain, the state and outlook of the Chinese economy has a significant impact on the price of both lithium feedstock and chemicals (as it does on the price of multiple other base and specialty metals). Uncertainty regarding the Chinese economy (specifically regarding property sales and consumer spending) in Q4/23, as demonstrated by the recent deceleration in PEV sales growth has dampened pricing sentiment. This has been compounded by a build up in inventory levels at many cathode manufacturers enabling them to delay spot purchases of lithium chemicals. Economic stimulus measures announced by the Chinese government in Aug 2023 have also not impacted the sector as expected. As a result, alarm bells have been sounding regarding lower-than-expected Q4 2013 EV sales, which has historically been the highest quarter for sales, and this has lithium prices on a downward trend. We believe these are short term shocks to the system and remind our readers to take a longer-term view on the space; our long-term outlook on lithium continues to remain positive.

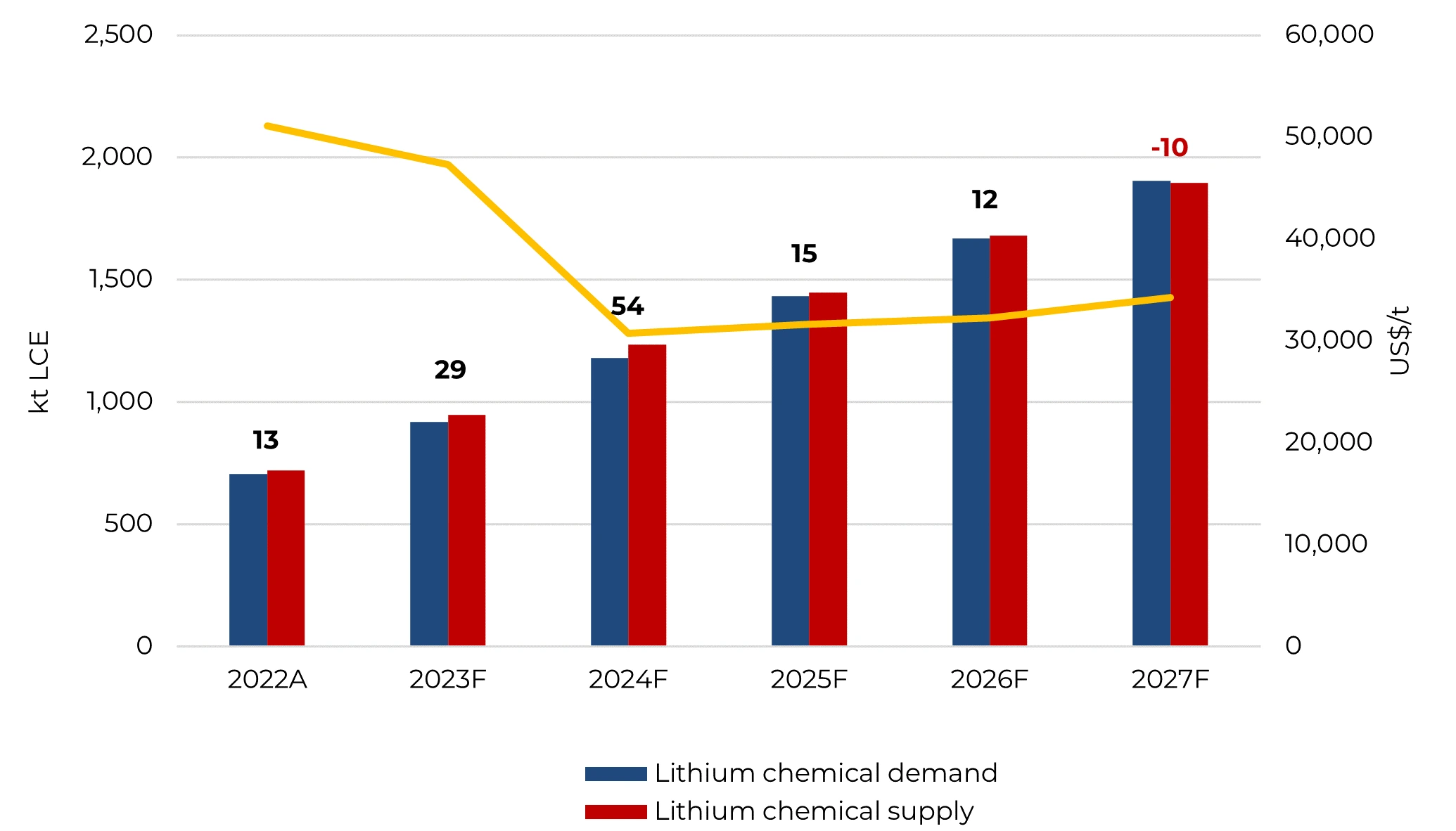

Long-term demand for lithium in our opinion will continue to stay strong and driven by the green energy transition and decarbonization goals set to be achieved by 2030. S&P Global Market Intelligence is forecasting a surplus in the market till 2026, with a deficit anticipated to begin in 2027 (Figure 2). While S&P is forecasting a lithium carbonate price of US$47,317/t for the end of the year, spot prices are currently well below this level, and in our opinion are unlikely to bounce back up to over $40,000/t for the remainder of the year. For 2027, a forecast price of US$34,240/t is anticipated.

We note that at Red Cloud Securities, we currently forecast a long-term spodumene concentrate price of US$2,500/t, carbonate price of US$26,000/t and hydroxide price of US$28,000/t. We maintain conservative prices given the volatility surrounding lithium and to demonstrate that even with lower than consensus pricing, projects coming down the pipeline are showing positive economic metrics. In summary, we continue to remain bullish on lithium, despite the negative sentiments putting downward pressure on current pricing levels.