By: Taylor Combaluzier, P.Geo VP, Mining Analyst

While battery metals, such as lithium, cobalt and nickel, have been getting the lion’s share of attention when it comes to the energy transition given its importance in making EV batteries, no discussion would be complete without taking account of copper and its importance underpinning this new technology.

Copper is essential to meeting the demands of EVs, power infrastructure and renewable generation on top of its traditional uses. EVs, charging infrastructure, solar photovoltaics, wind, and batteries all require more copper than conventional fossil fuel-based equivalents.

Indeed, the bullish sentiment for copper has been amplified by titans of the mining industry including Robert Friedland who said “…there can be no greening of the world economy without a radical global increase in responsible copper production” and Mark Bristow who stated that “…copper is the most strategic metal out of all the metals”.

We expect the green energy transition to drive copper demand. At the current time, greening the economy is anticipated to be largely achieved through electrification. This is evidenced by the US$1.2T infrastructure bill that was signed into law by the Biden Administration which is partly focused on clean energy – including EVs. We also note that numerous jurisdictions around the world are declaring targets for when all new vehicles sold will be zero-emission vehicles (Canada accelerated its target to 2035). We would expect these targets to be met in large part by the adoption of EVs, which require approximately three to four times more copper than ICE vehicles. Copper used in vehicles is forecasted to surge in the coming decade, essentially doubling to ~6Mt in 2031, as the adoption of EVs and hybrids increases. Overall, global copper demand is expected to surge by 82% between 2021 and 2035, from 25Mt to 39Mt according to S&P Global.

Turning to the supply side of the equation, the amount of copper required between 2022 and 2050 is more than all the copper consumed in the world between 1900 and 2021 according to S&P Global. Currently, maximum supply shortfalls of 1.6Mt to 9.9Mt are forecast for 2035. This underlines the monumental task of ensuring that there is enough copper capacity to meet demand. Increasing supply can be achieved via bringing new mines online, expanding existing operations or increasing output, and enhancing recycling.

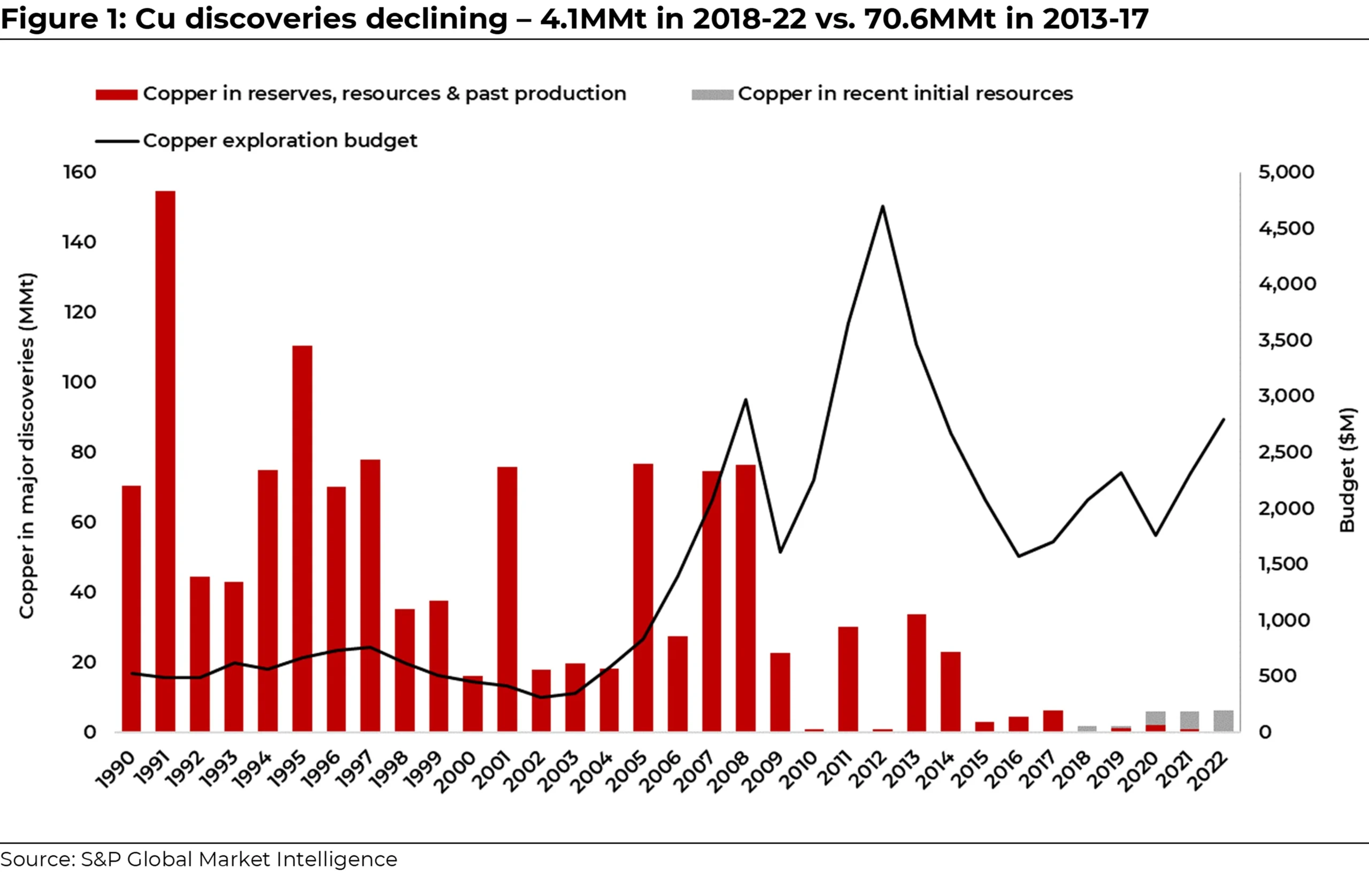

We believe there has been underinvestment in new copper capacity as the global trend toward electrification requires even more amounts of the red metal. With the majority of exploration budgets now focusing on extending older, known deposits we believe there could be an opportunity for investors to potentially benefit from more rewarding earlier-stage, generative exploration.

There has been a dearth of major copper discoveries in recent years despite higher exploration budgets (Figure 1). We note that only 18 major copper deposits (+500kt copper) were discovered over the past decade, containing 6% (74.7Mt) of all copper contained in discoveries since 1990. In our view, the increased demand for copper as a result of the burgeoning EV and green economy will provide a compelling catalyst for majors to replenish and grow the copper pipeline over the mid to long-term. We believe junior explorers and developers would be well positioned to capitalize on this looming supply gap if they are able to make a major discovery or define an economic deposit.

With these key points in mind, we believe there is starting to be a recognition of the looming copper supply gap by those outside the mining industry and the impact it could have on achieving energy transition objectives. We have seen a marked improvement in the recognition of this fact by governments around the world. Canada included copper on its critical minerals list in 2022, which committed C$3.8B over eight years to implement its critical minerals strategy, while the United States Department of Energy added copper as a critical material for the first time in 2023, which informs eligibility for tax credits under the Inflation Reduction Act. We believe a commitment by all stakeholders (governments, major mining companies, investors, and the broader public) is needed to support junior copper explorers so that they can make new discoveries, and to support developers so that they can secure financing and advance projects in a timely manner under a predictable regulatory environment. In our view, this commitment will be imperative to ensuring junior explorers are able to effectively discover and advance new copper deposits to guarantee future adequate mined copper supply to meet the needs of the greening worldwide economy.