By: Timothy Lee, Mining Analyst

Nickel production comes from two types of mineral deposits: laterite deposits and sulphide deposits. World resources in mineral deposits grading >0.5% Ni contain a total of over 300Mt Ni, with about 60% of this in laterites and 40% in sulphide deposits. Most of the production growth over the past few decades has come from laterites, particularly in southeast Asia.

Global nickel production from mines totaled 3.3Bt in 2022, with Indonesia accounting for 1.6Bt of this, according to the USGS. Mine production increased by 20% year-on-year, with most of the production growth attributable to Indonesia. According to the International Nickel Study Group (INSG), Indonesian mined nickel output surged by 31% year-on-year over the first seven months of 2023. Meanwhile, global production continues to centre around China, which lifted its own primary nickel production by 18% year-on-year in January to July 2023.

The increased mine production led to an 85% jump in production of intermediate products, such as nickel pig iron and nickel matte, and a 20% increase in primary nickel products, such as nickel sulphate. While primary mine production is shifting to Indonesia, this largely feeds end-product production in China, which continues to grow its refining capacity. China added 270,000t of capacity to process intermediates into nickel sulphate in 2022, according to Macquarie Bank, and Chinese and Indonesian companies have announced plans to increase nickel cathode capacity by 250,000t by the end of 2024. It is anticipated that this increased capacity to convert intermediate products to primary products should mean surplus spilling over into the type of nickel traded on the London and Shanghai markets.

As far as consumption, nickel is primarily used in the production of stainless steel and other alloys, but it has a growing use as a battery metal. According to the INSG, global consumption in 2023 is expected to total 3.2Mt, about 8% higher than in 2022. The bulk of this growth comes from electric vehicle batteries, compensating for sluggish growth in the stainless steel sector. About 65% of the nickel consumed in the western world is used to make austenitic stainless steel, according to the USGS. Another 12% goes into nonferrous alloys or superalloys. The remaining 23% is divided among rechargeable batteries, catalysts and other chemicals, coinage, foundry products and plating.

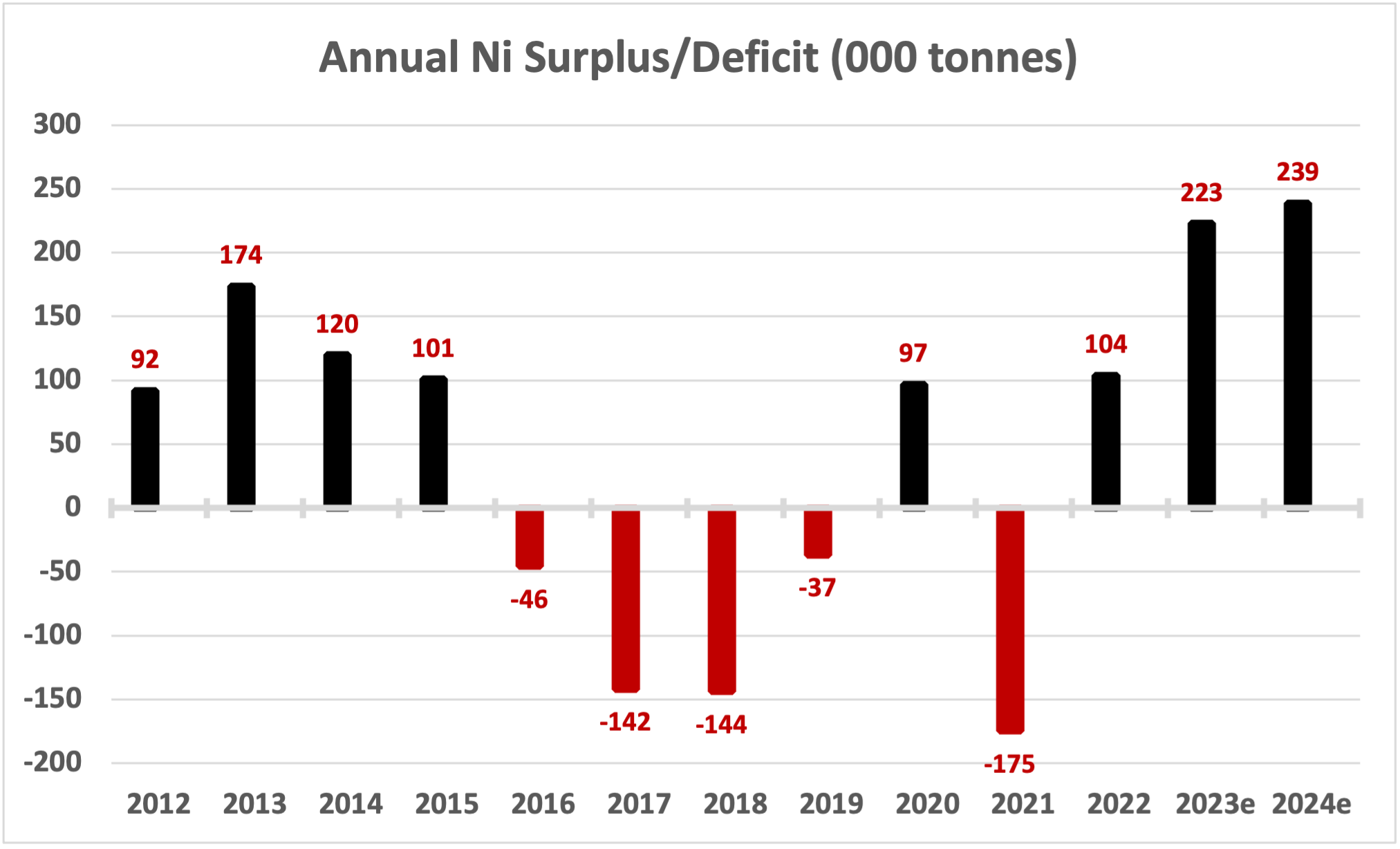

While consumption is rising, the INSG predicts that 2024 will be the third consecutive year of surplus nickel production (Figure 1). Nickel was in a deficit from 2016-2019 as well as 2021, when the annual deficit reached about 175,000t in 2021. However, with the significant increase in Indonesian mine production, the market had a surplus of about 104,000t in 2022, and this surplus is expected to increase in 2023 and 2024. As mentioned previously, consumption is expected to grow by 8% in 2023 and another 9% in 2024, but global production is expected to grow even faster, anticipated to be 12% higher this year and another 9% in 2024.

Source: International Nickel Study Group

The nickel production surplus has kept the nickel price suppressed, and this may continue in the near term. At a recent price of about US$18,440/t, or US$8.31/lb, nickel has underperformed most other metals in 2023, down 36% since the beginning of the year. The published nickel price is that traded on the London Metal Exchange or the Shanghai Metal Exchange. Notably, however, this is the price of finished Class I nickel metal, and many intermediate forms of nickel, such as pig iron or nickel sulphate, are not reflected in this as they are used in their intermediate form and never refined to nickel metal. The refined metal price is still well above prices of intermediate products, indicating a disconnect between a tight Class I market and a surplus in the Class II segment. However, as more refining capacity comes online, the surplus in mine supply may trickle into the refined metal market. This is perhaps already happening, as LME and Shanghai stocks have been rising in recent months, after bottoming out this past summer.

In summary, the production ramp-up in both mine production in Indonesia and overall processing and refining capacity in Indonesia and China is keeping nickel prices low in the near-term, but the increased need for nickel in EV batteries should help support demand growth in the long term.